The government implements COVID-19 containment measures that shuttered offices and businesses and affected the demand for commercial real estate. The pandemic also blurred the industry outlook companies implemented work-from-home initiatives. A recent IMF analysis discovered that these trends could cause a disruption in the market and possibly threaten financial stability.

The Relationship to Financial Stability

The commercial real estate sector can potentially affect broader financial stability because price movements reflect the expansive macro-financial picture. Moreover, it depends heavily on debt funding. Loans comprise a considerable portion of banks’ lending portfolios, and in some cases, nonbank financial intermediaries also play a role.

An adverse shock to commercial real estate can decrease its prices and affect the credit quality of borrowers and the balance sheets of lenders. Falling prices have their risk of price misalignments. Commercial real estate prices can deviate from economic fundamentals can magnify the dangers of future growth. For example, a drop of 50 basis points in the capitalization rate can increase the downside risks to GDP growth by 1.4% in the short term and 2.5% in the medium term.

The Damage Caused by COVID-19

Increased price misalignments are an evident effect of the pandemic, and it comes from the sharp drop in operating revenues and overall demand. However, they can diminish as the economy starts gaining momentum. The possible structural changes in the market will prove to be challenging to the sector. For instance, an increase of 5% in the vacancy rates can result in a 15% drop in fair values after five years.

The Role of Policymakers in Offsetting Financial Stability Risks

Nonfinancial firms get help in accessing credit through low rates to help in the commercial real estate recovery. However, the uncomplicated financial conditions entice risk-taking and add to the pricing misalignments. Policymakers can use their macro-prudential policy toolkit to restrict the debt service coverage and loan-to-value ratios to address the vulnerabilities.

Moreover, policymakers can broaden the reach of this policy by covering nonbanking financial institutions. Lastly, ensuring the strength of the banking sector and performing stress testing can help decision-makers setting aside adequate capital for commercial real estate exposures.

Ten Ways Innovation Will Affect the Commercial Real Estate Post-Pandemic

COVID-19 has wreaked havoc on everyone, and one of its most affected industries is commercial real estate. As businesses shut down and others work remotely, only a few stores remain open. New ventures are hard to come by, and demand for purchase or lease of commercial buildings is low. However, as many people know, these effects are only temporary.

With the world slowly returning to normal, employees return to work, and stores begin to open. Commercial real estate is abuzz, and with this development, innovation is now awash with possibilities. Here are ten ways how the industry will respond to the global pandemic effects:

1. Heightened Demand for Multifunctional Spaces

The pandemic increased the number of people working from home. As companies become open to employees doing virtual work, developers must include aesthetic and functional pockets in interior spaces conducive to work. Privacy, advanced digital capabilities, and adaptability of rooms for recreational use during non-working hours will determine the new home office.

2. Increased Need for Sustainable Buildings

Buildings add about 40% of global carbon dioxide emissions; therefore, real estate leaders must spend on healthier materials and energy-saving designs. As governments implement stricter regulations about sustainability, properties that do not focus on it will lose value because no one will occupy them. They become uninsurable and obsolete too.

3. Changing Definitions for Real Estate

The merging of residential and commercial real estate will force the industry to create a more specific definition of commercial. The merging of working, playing, and living spaces, together with the ways to own and invest, will require inventive and iterative meanings to account for the changing operations of economic progress and the future of living.

4. Focusing on Nearness to Home and Work

Community development requires the building of more spaces for living, playing, and working. More and more people value their time and quality of life. Proximity to play and work areas are now more appealing to reduce expenses and travel time.

5. Transforming Unused Office Spaces

Because of the considerable decrease in office space demand because of the digital economy and work-from-home initiatives, underutilized commercial spaces will become condominiums.

6. Soaring Real Estate Automation

Artificial Intelligence (AI) will reduce operating expenses at the corporate and property levels. The commercial broker and appraiser will have a reduced rule over time because of the automation of most activities.

7. Rising Demand for Technology Solutions

Legal tech will automate and centralize case management because of the volume of transactions. The industry can use AI to predict foreclosure timelines for more efficiency.

8. Modernizing Housing Developments

Because of work-from-home initiatives due to COVID-19, housing design will experience the most significant innovations. Owners and developers will rethink their house layouts. Much of the time spent in the residence will be in the at-home office.

9. Integrating Data with Relational Information

Access to real estate knowledge, data, and information will improve due to technology. Real estate professionals control the integration of this access with appropriate relationships and experience, but they must always focus on relationships.

10. Increasing Number of Portals for Commercial Real Estate

More property portals will pop up because they have to reach more clients across markets. Companies will cooperate to serve the needs of prospects and owners.

Final Thoughts

The COVID-19 pandemic has wreaked havoc on all industries, but the commercial real estate sector is one of the most heavily affected areas. This large sector can cause financial stability risks that policymakers can reduce by using their macro-prudential policy toolkit.

Aside from the damages, the pandemic is also a way to implement many innovative ways to help the commercial real estate sector:

- Increased demand for multifunctional areas

- Heightened requirement for sustainable structures

- Evolving definitions for commercial real estate

- Concentrating on proximity to work and home

- Revamping unused office spaces

- Increasing real estate automation

- Spiraling demand for technology

- Improving housing developments

- Merging data with relational information

- A growing number of portals for commercial real estate

These ten predictions for innovation can help the commercial real estate sector to get up on its feet again post-pandemic. The eagerness and willingness of everyone involved can make these forecasts become a reality soon.

About the Author

Charlie Svensson is a fast-rising and charming freelance writer for writing services australia. He uses his excellent skills in blogging and content writing while actively providing proofreading services UK. Charlie loves to write about social media, SEO, self-growth, education, marketing, and motivation blogging. As an assignment help writer, he can quickly adapt his skills to engage his diverse audiences.

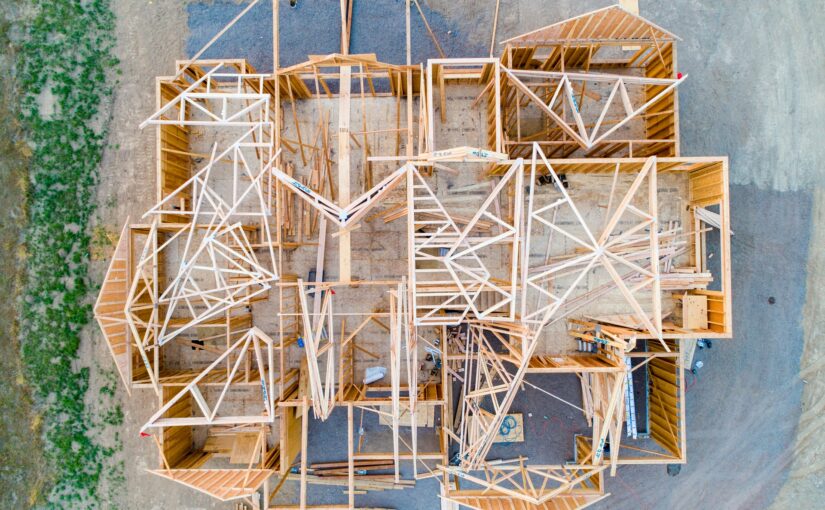

Image by xf747695427 on Pixabay